"Nature is the source of all true knowledge. She has her own logic, her own laws, she has no effect without cause nor invention without necessity." ---Leonardo da Vinci

There are endless things to read, watch, learn, and understand. Sometimes it's our choice to learn things, just for fun, and sometimes we are forced to learn for our well being and survival. We evolve as human beings, not by making more complicated things, or making things more complicated, but by relearning things that we have misunderstood about ourselves and our world. This is best done through nature. While Mother Nature is the source of all true knowledge, the Internet is a sexier version of her in society. The Internet is the "nature" of our high-tech digital world.

The more that I think, the more I realize what an incredible aberration we are living through. We have so much knowledge, and so little common sense. If something about nature isn't empowering us, we believe in our human right to tune it out. We can be anything and do anything we want, so long as we think we can. Funny thing is that nobody in my village in Cameroon or Ecuador thought like this...just my fellow Americans. When I was a young martial artist, my instructor wouldn't allow us students to say the word can't, for example. This four-letter word is the reason why I developed strong shoulders, since I had to do pushups every time I spoke it. In Cameroon, women get strong shoulders from work!

Imagine a bunch of lions and tigers and bears sitting around a table, nibbling on chocolate-chip cookies, sipping hot imported coffee, while chitchatting about their real estate ventures and vacation holidays. Silly images, I know. Do this, and you begin to realize how truly ridiculous is our species to think that we've somehow overcome the natural world. Even more ridiculous is what we believe, like real estate always goes up. How does decaying wood and/or other natural materials become more valuable over time when they’ve been rearranged into a house? They don’t! It's just that we believe we are the "exception" to nature---we've figured out how to rise above.

In a similar way, it's common knowledge that stocks always go up. But natural resources and energy that's used to build, transport, and power society hasn't gone up, relatively speaking. The top five stocks in the world (Microsoft, Apple, NVIDIA, Alphabet, and Amazon) now have a combined market cap of $14.47 trillion. The third, fourth, fifth, and sixth largest countries (Japan, Germany, India, and the United Kingdom) have a combined GDP of $14.75 trillion. Microsoft, with a market cap of $3.475T, is valued more than than the GDP of India at $3.385T. Apple is worth more than India, too! I have a hunch these aren't real valuations though.

I watched an interview last week about how real estate is now coming down in certain areas of the country, particularly areas where costs for insurance and maintenance have gone up the most. Some real estate owners are taking big losses. This got me thinking about the mechanics behind real estate, and how lucky the Baby Boomers were to buy during the early stages of the boom. They had foresight into a new trend that was developing, and took advantage of it. Those who caught it early made a fortune. Those who caught it later did well, too. And those who missed it are still trying to make a fortune doing the same thing that the Boomers did.

Throw a baseball up in the air, and you can kind-of figure out when it will slow, reverse, and start downward. Baseballs are subject to gravity as real estate values are subject to supply and demand. Anyone who thinks baseballs can defy gravity, or real estate values defy supply and demand, needs to think again. Real estate went up for a long time because supply and demand went up. That's the reason! While it may seem like the Boomers were alchemists, creating value out of thin air and decay, there was no magic involved...just three natural phenomenon that happened simultaneously. These are the exact same reasons why the stock market went up, also.

1) The population boomed and this created growth in industry and markets. More homes were needed for evermore humans, which is what fueled the industrial revolutions on the back of oil, and other fossil fuels. I was surprised to find out that Millennials (born between 1981 and 1996) are the largest generation group, surpassing even the Baby Boomers. Unlike the Boomers, however, Millennials don't like large homes. So who is going to buy those costly mansions from Boomers? Nowadays, tiny homes have gone from a millennial lifestyle fad to a Hail Mary shot at solving the homeless crisis. Not to mention they're more energy efficient and cheaper to maintain.

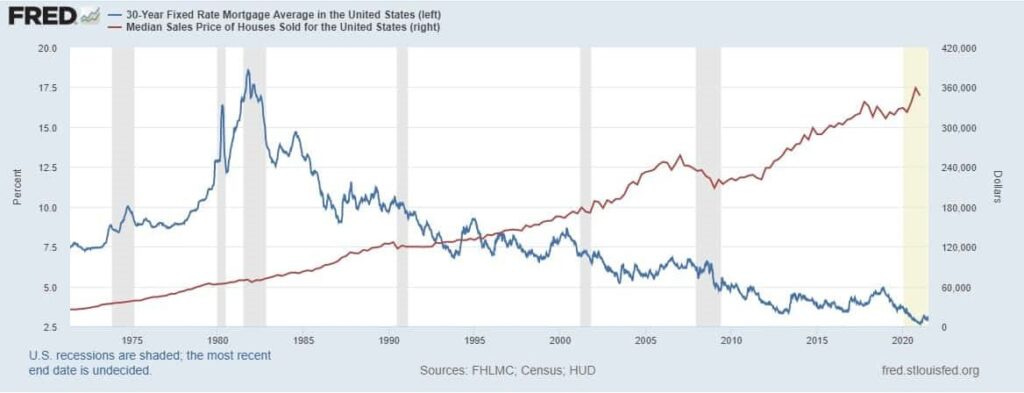

2) Interest rates went down, making it cheaper and cheaper to borrow. This also increased supply and demand. People were incentivized to take out mortgages and finance real estate in an environment where real estate only increased in value. Easy money for the middle class! While this chart is a few years old, it's obvious that interest rates are inversely correlated to housing prices. If lowering interest rates encouraged home buying, then raising interest rates will encourage people to sell, driving prices down considerably. What's the Fed gonna do? They have two choices, save the markets or save the currency...the debt is gigantically unsustainable.

3) Travel, leisure, and entertainment became the top business ventures in the world. When Airbnb was born in 2007, it opened up the hospitality industry to everyday people who could make easy money by renting out their homes on a short-term or long-term basis. Easy money became the name of the game, and this motivated evermore investing in real estate, adding more fire to the supply and demand. As ordinary people started making more easy money, they too were able to travel and spend on leisure. The hospitality industry fed on itself and people fed on the industry, and it just exploded.

The real estate boom was therefore fueled by a population boom, a credit boom, and an entertainment boom. And these booms were fueled by a cheap but shrinking supply of energy, made possible by a growing pile of debt. So far, the Fed has been raising and holding interest rates, but the U.S. Treasury is having difficulty selling bonds, AKA borrowing money. While people seem to think that all these booms will keep on booming, it isn't natural during periods of scarcity. Booms always go bust, eventually. When the government cannot borrow at the ever-increasing pace with which it spends, who knows what will happen?

What struck me in the interview above is that things can and do change quickly, often without public awareness. In some cities, real estate inventory is up 1000% over the past few weeks, and big investors are selling. Apparently, investors own a quarter of all houses in the U.S. Imagine what happens when the population starts declining, when the credit bubble bursts, and when the true value of energy and natural resources emerges after being suppressed by debt. The source of all true knowledge (nature) becomes relevant again, and people open their eyes and see.

My blog posts are published every Sunday, and they're free for anyone to read and share. If you would like to support me financially in this weekly process of thinking and writing, I'd be most grateful. For this reason, I started a Wendy Williamson Patreon page. If Patreon isn't your thing, you can send a one-time gift via Paypal to me@wendywilliamson.com. Thank you!

Our planet is swimming in energy but like a fish in water we can't see it. Nicola Tesla saw it but his whacky theories couldn't be allowed in a world of Einsteinian "Fauxics"so the UZOG confiscated all his papers upon his death and probably buried them under lock and key in some DOD vault. Same issue with the US Patent office which is literally operated under contract by - wait for it - our Zogish cousins in Britain - no free energy for the peasants! The good news is we have just left the dark ages and entered a new age which will rewrite all the old paradigms / religious beliefs in Einsteinian "science".